ACORD WARS: Episode II

In the history of the ACORD form, there are unique reasons that certain elements may not be required for an agent to receive a quote. Some articles of information are secondary to others. This is where things get interesting. Because agents and underwriters have a symbiotic relationship, when one party excels so does the other. However, progress can come to a screeching halt for several reasons, with one of them occurring when an underwriter doesn’t receive enough information from an agent to give an accurate quote. There is however a delicate balance when differentiating between the must-haves and the nice-to-haves.

On planet Earth, effort is typically a good thing. But work for the sake of work itself is not the key when completing ACORDs. There are a couple of simple shortcuts that are seldom considered solutions, and we encourage anyone racing to make it onto their spaceship to apply these tricks!

A skilled underwriter is likely to see that they can quote regardless of a lack of certain information. Here are two items that an agent can omit (just in case their space ship is leaving).

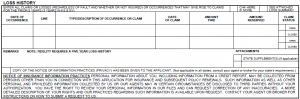

Loss History –

Loss History is considered to be any information about previous claims. What are the details of the circumstance? If there are any, the agent/applicant can and should disclose this information to better represent the applicant’s history.

Click the images to enlarge.

Why it isn’t required: Because an underwriter can process the quote ‘subject to’; therefore if the loss information is provided, great! If any existing loss information was omitted, the quote will simply need to be revised afterwards once the loss information is received.

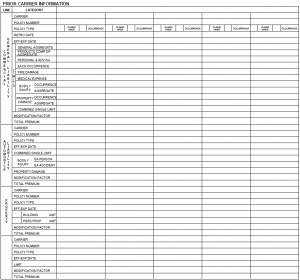

Prior Carrier –

Prior Carrier is information about previous coverage or insurance policies including which carrier was writing their insurance.

Why it isn’t required: Essentially, information used to rate and make important underwriting decisions is what underwriters are essentially looking for. This is mainly supplemental information and not always a factor in the quoting process.

These shortcuts can potentially help to cut down on time when the potential policyholder is in a hurry, which can help lead to a faster quoting process.

Make sure to read ACORD WARS: Episode I and stay tuned for ACORD WARS Episode III: The Real Reason to Provide an Accurate Business Description, coming soon!

May the forms be with you!

← « ACORD WARS Episode I: The ACORD FORMS Strike Back! | Why Insured’s Bind Behaviors are Driving the Evolution of the Industry » →

©2024 MacNeill Group. All Rights Reserved.Terms of ServicePrivacy PolicySite Map

800-432-3072

800-432-3072