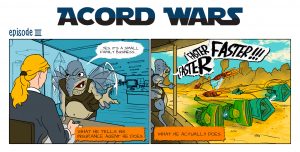

ACORD WARS Episode III: The Real Reason to Provide an Accurate Business Description

In General Lines, providing a business description on an ACORD form is typically a simple process. But sometimes things can get a little sticky. Here’s an example of good intentions gone wrong:

A client owns a shoe store and describes their business as such to their agent. Therefore, the agent describes the client’s business to an underwriter as an ordinary run-of-the-mill shoe store when in actuality there are some very unique and potentially problematic circumstances surrounding said shoe store.

The reason? This is a special shoe store. And why is that? The shoes in this store are made from Italian leather imported directly from an Italian manufacturer. However, the client doesn’t provide this information to their agent. Perhaps the details of the shoes seem inconsequential to the store owners because they are so familiar with their product.

The next thing we know, the underwriter selects an inaccurate classification. When the discrepancies are eventually discovered, if the policy is still active the underwriter will need to revisit the policy with an endorsement which can result in increased fees amounting to up to 25% of the policy’s premium.

If only a time machine existed to erase what’s happened! Alas, we live in a pre-time travel era.

But we can provide a few simple tips for agents to prevent this from happening.

- Find out how the product being sold is made. In this case, having an idea of how the shoes were made could help to grasp the cost to replace/repair them.

- Who is their supplier? It is important to keep this information on record in case the product is faulty. Having all of the facts on paper can ease complications later down the road.

- Where are they located? If the manufacturer is based outside of the U.S., the party liable in case of damage will be the shoe store. Otherwise, the liable party is the manufacturer. It will be best if this information is given upfront.

These questions can be generalized in most cases. In some scenarios, the questions that aren’t asked are the ones that should be asked the most. Ultimately, more information leads to more protection for an insurance agent.

← « The Tool Agents Are Using to Increase Renewal Retention | ACORD WARS: Episode IV » →

©2024 MacNeill Group. All Rights Reserved.Terms of ServicePrivacy PolicySite Map

800-432-3072

800-432-3072