ACORD WARS: Episode IV

The most desirable outcome for any agent is to have the ability to master their own destiny, especially when focusing on new business. Most people believe that their actions have a direct impact on their success or failure, although sometimes this simply isn’t the case, which can be exasperating! The transition from moving at a swift pace and gaining momentum at work to halting to a complete stop for another party to take the reins is nothing but anxiety inducing. This explains why it is so easy to fall into the trap of feeling powerless when submitting for a quote to an underwriter. But is it possible that agents have more control than they think? Absolutely.

As the saying goes, “beauty is in the eye of the beholder,” could it be that agents can change their outcome by changing their outlook? By approaching from a different angle, it’s very possible that agents are able to bypass a lengthy process.

Sure, underwriters will want you to believe that crossing every “t” and dotting every “i” is the only way to submit for a quote. But when it comes to ACORD forms, there is a huge difference between the meat and the gristle. This helpful leverage is not without the aid of a few simple tricks as a guide from our friend Yoda’s playbook.

In General Lines, any underwriter will need three basic ticket items in order to give an agent the best possible results. Generally, nothing less and nothing more is required unless prompted by the underwriter as supplemental.

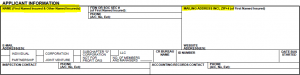

1. Most importantly, remember to insert the insured’s name and mailing address.

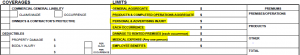

2. Limits- How much are they insuring for? With this section, an underwriter is looking to see how much the carrier will pay out to the insured in the case of a loss.

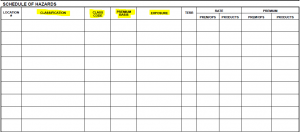

3. Schedule of hazards- classification, class code, premium basis (payroll, sales, or area), and exposure area.

These three pieces are the skeleton of the ACORD, and most underwriters should be able to quote or at least get a firm idea of a base premium using this information.

Stay tuned for ACORD WARS Episode V: Why You Should Always Specify Your Limits, coming soon!

← « ACORD WARS Episode III: The Real Reason to Provide an Accurate Business Description | 5 Creative Ways to Thank Your Clients » →

©2024 MacNeill Group. All Rights Reserved.Terms of ServicePrivacy PolicySite Map

800-432-3072

800-432-3072