ACORD WARS: Episode V

A limit is the maximum amount of coverage that a carrier will pay in the event of a loss. Naturally, higher limits equal higher premiums, but some insureds are unaware that they have the capability to choose their limits. While it is advisable to expand the limit of a policy as high as possible, some insureds would like the opportunity to lower their limits, in turn lowering their rates. In the event that a policyholder does not specify their desired limits, the underwriter will automatically assume that the insured would like the basic limit, which is either one or two million dollars.

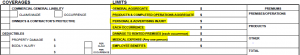

Generally, the basic limits can be found in the 126 for liability.

126:

Although the basic limit is anywhere between $1-2 million, when policyholders decide to make an adjustment it is typically somewhere between $300-600 thousand. If an insured is requesting lower limits, their agent should ask some questions as to how much they want to be protected.

If the numbers add up, then it would be sensible to encourage the policyholder to lower their limit. For liability, lowering limits can get tricky. Most businesses have a lot at risk in the event of a hazard. If held liable, companies may need to pay millions of dollars which can be covered by requesting an Excess Liability policy.

The answer is this: an insured has the right to choose lower limits if they are available. It is advisable to only encourage this if the insured has evaluated the full course of their business and is ready to take on the extra load if the time comes.

Stay tuned for ACORD WARS Episode VI: Going digital, signatures are so last episode…

May the forms be with you!

← « 5 Creative Ways to Thank Your Clients | ACORD WARS: Episode VI » →

©2024 MacNeill Group. All Rights Reserved.Terms of ServicePrivacy PolicySite Map

800-432-3072

800-432-3072